British Virgin Islands is a member a member of the British Commonwealth and situated between the Atlantic and the Caribbean. As BVI company is not required to pay taxes, nor bound to foreign exchange controls and, information for submission requested by local government is minimal. Thus, BVI is a favorable place globally for offshore registration.

The following objectives can be achieved by BVI investment:

· Oversea listing

· Springboard Investment seeking

· Facilitate liquidity by registration of holding company

Advantages:

· Simple application procedure

· No tax shall be declarable and payable

· Registered capital is not required, and bank accounts can be opened all over the world

· Companies names can be in Chinese

· Not audited accounts submission requirement

· Provide privacy protection, disclosing shareholders and directors is not required

Our services:

Professional

· Rich and comprehensive experience of wealth management

· Discerning financial market analysis

· Flexible and professional investment strategy

· Rigorous risk assessment and management

Comprehensive

· Provide variety of financial plan and investment choice

· Enrich client’s choice by providing latest financial products

High end VIP exclusive

· Money Concepts private wealth platform help you capture every market movement and opportunities

· Manage your account quickly

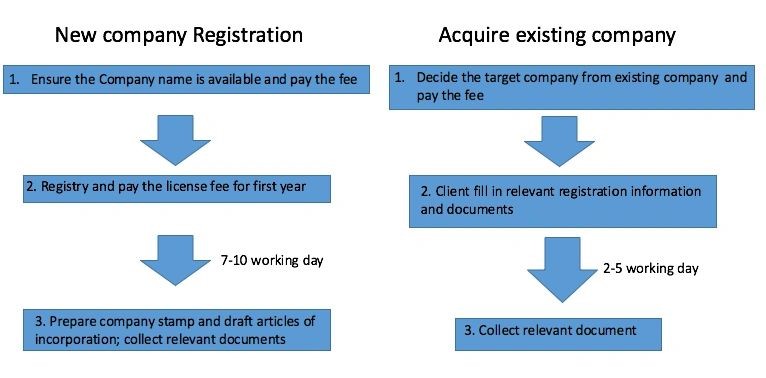

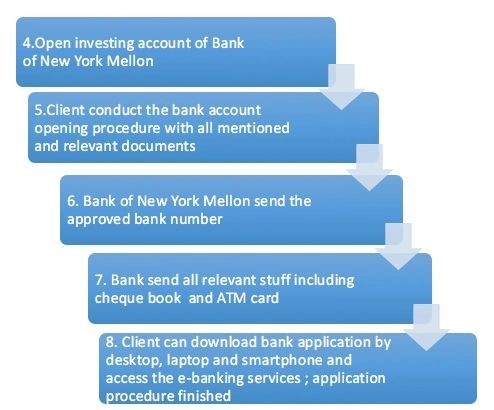

Procedures: