WHY CHOOSE MONEY CONCEPTS WEALTH ACCOUNTS

Money Concepts Private Wealth Account is an advance and international wealth management Account. All accounts in Money Concepts Private Wealth Account are under the clients’ own name, in custody and segregated into individual by Pershing LLC, a subsidiary of Bank of New York Mellon.

- Freedom of Portfolio Switching

- Access to World Class Top Performance Investment Products

- Optimize your Wealth through Diversification

- Investors’ Protection Peace of Mind

- Dividend Payout adds value to your Investment

- Beneficiary service available

- Comprehensive Customer Service

- Prestigious Value-added USD Cheque and Debit Card services

- Expert portfolio manager helps to achieve your targeted return

Bank of New York Mellon

www.bnymellon.com

- Top 3 private banks in U.S.*

- It has one of the longest histories in the United States; it was founded in 1784, and listed in New York Stock Exchange (BK)

- The world’s leading asset management and securities services company

- Received credit rating Aa2 by Moody’s, and AA- by Standard & Poor**

- Named as one of the greatest corporation in Fortune 2012**

- More than US$1.7 trillion in assets under management**

- More than US$30.5 trillion in assets under custody and administration**

*Barron’s Penta 3/12/2011

** Information up to 30/9/2016

Pershing LLC

www.pershing.com

- A wholly owned subsidiary of Bank of New York Mellon

- Founded in 1939 with more than 70 years of experience in securities, serving over 1,600 financial institutions and investment consultant companies

- Providing highly efficient custody and state-of-the-air financial services for more than 5.5 million investors

- Highly recognized in U.S. financial industry, and awarded The Best Customer Brokerage Statement by Dalbar

- Has US$1 trillion in assets under custody and administration*

*last update 20/06/2014

Securities Investor Protection Corporation

www.sipc.org

- SIPC provides up to US$500,000 of protection for each Money Concepts Private Wealth account, which opens under Pershing LLC

- SIPC was established in 1970 under the instruction of U.S. Senate to protect investors’ assets

- For coverage in excess SIPC limits, investor asset are insured up to US$1 billion by a group of insurance companies

TYPES OF ACCOUNT

Money Concepts Private Wealth Account is a full-ranged wealth management Account for individuals and corporations who seek world class financial services. We utilize clearing and custodian services provided by The Bank of New York Mellon Pershing LLC . All investments are segregated into individual client accounts under The Bank of New York Mellon Pershing LLC. Investors’ assets are protected by Securities Investor Protection Corporation (SIPC) as well as globally reputable insurers.

- Wealth Advisory Account (Fee-based)

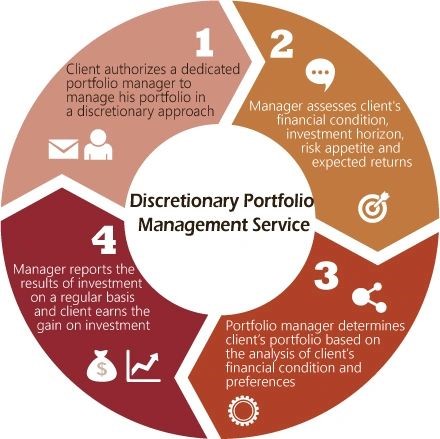

Stand close with clients’ benefit. The Wealth Advisory Account is a Fee-Based account as a fixed percent of a Management Fee and an Advisor Fee. There will be no commission that will be charged. Advisors fee will be directly proportional to client’s total asset value; therefore, conflict of interests between financial advisors and their clients could be minimized, resulting in a win-win situation for long term relationship. - Discretionary Portfolio Management Service

With our discretionary Portfolio management service, you can delegate the daily management of your assets to our specialists, saving you time while ensuring professional supervision and active management of your fund portfolio.

Clients can authorize their portfolio managers to manage their account in full discretion and make investment decisions on behalf of the clients. Based on clients’ investment objectives, expected returns and risk appetite, our managers make investment decisions of clients’ best interest.

BENEFITS OF OUR SERVICE?

- Professional management: Our fund managers with extensive knowledge, skills and experience provide you with professional portfolio management service, ensuring you a hassle-free life.

- Personalized solutions: With an in-depth analysis of your financial conditions, investment goals, preferences on risk and return, we will construct a tailor-made investment portfolio to fulfill your financial needs and objectives.

- Risk management: Our hedging techniques enable us to diversify the allocation of your asset, reducing the investment risk to minimal.

- Saving your time: Delegating your daily management of your assets to our fund managers saves your time and effort. Our specialists will carry out all necessary market research and analysis in order to manage your portfolio effectively.

WORLDWIDE INVESTMENT PRODUCTS

Find the solutions that meet all your unique needs from the various investment products that Money Concepts Private Wealth Account has to offer.

-Fund

Over 5,000 offshore managed funds

Over 1,610 Exchange Traded Funds (ETF)

-Stock

Global stocks: Hong Kong, U.S., U.K., Japan, Canada and ADRs etc

-Bond

Initial public offer or second hand global bonds

Issued by government or corporation

Various currencies, maturity, rating and coupons are available

-Foreign Exchange

Accept deposit and dealing of all major currencies, including: USD, RMB, Euro, GBP, CAD and AUD etc

– Certificate of Deposit

Issued by banks

Available in various currencies

Deposit duration available in 1, 3 , 6 months and 1 year

-Structured Notes

Equity or Currency Linked Notes

AFTER-SALE SERVICES

– Online Valuation System

24-hour accessible online account services with latest assets value

-Easy Withdrawal and Payment

Clients opened a Corestone Account™ can:

Withdraw cash in local currency from over number of 1.75 million ATMs from PNC; Bank and Allpoint network world-wide; Make purchases easily with Visa debit card; Write cheque in US dollar.

– Beneficiary Services

Clients may sign an additional agreement over assets transfer on death and designate beneficiaries and their corresponding percentage; Upon receipt of notice of account holder’s death, Pershing LLC will distribute the assets in the account to the designated beneficiaries; Without requiring certification of the will ; Without requiring instruction from a will or a court order.

-Tax Advantage

For non-US resident, their offshore asset is not subject to any taxation in US, but this benefit does not apply on dividends from both U.S. stocks and U.S. ETFs.

-Investment Capital Pays In

All Payments to Pershing LLC must be transferred from clients’ bank accounts directly

– Payment method:

HKD Cheque , CNH Bank Draft , Telegraphic Transfer of USD or other currencies